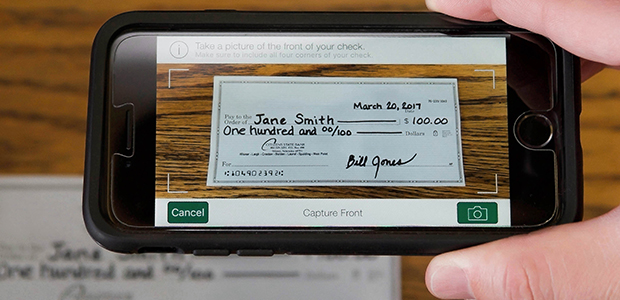

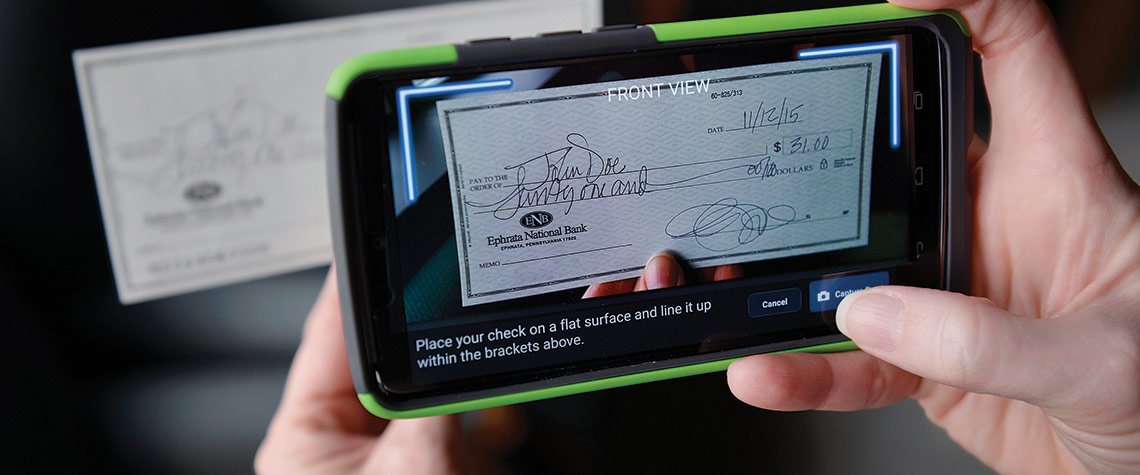

For all Mobile Check Deposit Users, the original check(s) you deposit using the Services must be accessible for a period of sixty (60) days after transmission to the Credit Union. After such period expires, you will destroy the original check. MyMerrill Mobile Check Deposit. Mobile Check Deposit on the MyMerrill mobile app allows you to securely and conveniently deposit checks anytime and anywhere into eligible Merrill investment accounts. Once you log into the MyMerrill mobile app: Tap on the check deposit icon. Using your device’s camera, take a picture of both sides of the check. Depositing a paper check doesn’t require a trip to a physical location when you use Mobile Check Deposit in the Renasant Mobile App. Just upload a photo of the front and back of your check, confirm the deposit amount and you're all set!

- Mobile check deposit allows you to save time by depositing your checks remotely, no matter where you are or what time of day it is. Instead of making a run to the bank, you can simply snap a.

- Mobile deposit There’s two ways to deposit a check to your Walmart MoneyCard with your smartphone. Using the Walmart MoneyCard app, you can take a pic and see your money deposited into your account right from your smartphone free of charge.

Hello, Time Saver

Everything you need to know about mobile deposit is right here.

Why it’s Easy

Now There’s One Less Thing on Your To-Do List

No Trips to the Bank

You choose when and where you deposit — anywhere in the United States.

No Extra Downloads

All you need is the latest version of the Capital One® app to use the mobile deposit feature.

How it Works

Snap. Deposit. Done.

Deposit from pretty much anywhere.

Open up the Capital One® mobile app

Sign in and tap your checking or savings account.

Make a Deposit

Select the Deposit icon.

Snap a picture of your check (front & back)

Show it a little love with good lighting, a dark background, and a view of all 4 corners. Flip over to the back, make sure you’ve signed the check before taking a picture.

Give us the details of your deposit

Enter the check amount and add a short memo if you'd like.

That’s it — wrap it up.

Give everything one last glance and swipe the Slide To Deposit button to confirm.

Your check will show as pending right away — and as long as it's received before 9 p.m. ET on a business day, it should post the same day. Plus, we take extra steps to make sure you get the latest updates.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Chase QuickDeposit℠

Deposit checks with the Chase Mobile® app.

- Overview

- Getting started

- FAQs

- Resources

Use Chase QuickDeposit℠ on the Chase Mobile® app to deposit your checks and access your funds quickly.

Save a trip to the branch and deposit checks on your schedule, virtually anytime and anywhere.

Deposit checks securely from your mobile phone or tablet. We protect your information and never store your passwords or check deposit data and images on your mobile device.

How to get started

Watch how it works with this helpful how-to video.

Mobile Deposit Bank Of America

Choose 'Deposit checks' in the navigation menu of your Chase Mobile® app and choose the account.

Enter the check amount and tap 'Front'. With our new 'Auto Capture' feature, the picture of the front and back of the endorsed check will be captured — or you can choose to take the pictures manually.

Confirm the details, submit and you're done.

Common questions answered

How does Chase QuickDeposit℠ work?

expandIn the Chase Mobile® app, choose “Deposit Checks” in the navigation menu and select the account. Enter the amount of the check and tap 'Front'. With our 'Auto Capture' feature, the picture of the front and back of the endorsed check will be captured — or you can choose to take the pictures manually. Verify your information and submit your deposit. After you submit, you can deposit another check or view the receipt. You’ll get an email when your deposit is received — and another when it’s accepted. If the deposit is rejected, you’ll also get an emailed explanation. Remember to properly endorse the back of the check with your signature and 'For electronic deposit only at Chase.'

Mobile Deposit Money Order

When will my funds be available?

expandDeposits submitted before 11 PM Eastern time on a business day generally will be available by the next business day. Deposits submitted after 11 PM or on a non-business day will be processed the next business day. However, we may delay availability if we require further review of the deposit. Any information about delayed availability will be provided in the Secure Message Center, which is accessible in the main navigation menu.

What should I do with my check(s) after I’ve deposited it?

expandAfter you complete your transaction, write “deposited” and the date of deposit on the face of the check. Please retain the marked check for two business days or until you receive our notification that your QuickDeposit has been accepted. After that time, you may destroy it.

Have more questions?

24/7 access to deposit funds

- Chase QuickDeposit℠ — Securely deposit checks from almost anywhere.

- Chase ATMs — Conveniently deposit up to 30 checks and cash at most ATMs.

- Direct deposit — Automatically deposit paychecks.

Pay bills quickly & conveniently

- Online Bill Pay — Pay rent, mortgage, utilities, credit cards, auto and other bills.

- Chase QuickPay® with Zelle® — Send and receive money from almost anyone with just a mobile number or email address.

Helpful technology that saves you time and keeps you in the know

Mobile Deposit Banks

- Paperless statements — Digitally access up to 7 years of statements.

- Account alerts — Monitor finances, avoid overdrafts and more.

- Chase text banking — Check balances and transaction history with a text.